GST model in Malaysia

GST, a multi-stage consumption tax, is based on consumption rather than earnings and can be charged on virtually all supplies of goods and services. The proposed implementation of GST will replace the current Malaysian service tax and sales tax.

Broadly, GST works by offsetting GST paid on purchases (input tax) against GST due on sales or supplies made (output tax). This is referred to as the credit offset mechanism. The multi tier stages of tax helps to ensure that GST paid by businesses for purchases does not end up being a permanent cost. However, the consumer ultimately bears the burden of the tax.

How GST affects businesses?

Where GST is implemented, the taxpayer must be registered with the Royal Malaysian Customs once the taxpayer achieves a certain prescribed annual sales turnover. The registered taxpayer would also be required to submit periodic GST returns. If the output tax is greater than the input tax, the taxpayer will have to pay the excess. Conversely, if the input tax is greater than the output tax, the taxpayer could seek a refund from the Royal Malaysian Customs.

How does GST work?

-------

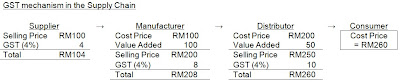

Let's say the selling price from the supplier is RM100, and where 4% GST is charged.

The supplier then charges the tax to the manufacturer, where you can see "value added" is pushed on.

When the distributor receives and pays for the tax, it's transferred to the consumer at the end price.

Payment of GST to the Government

- Supplier will pay RM4 (output tax) to the Government.

- Manufacturer will pay RM4 (output tax of RM8 less input tax of RM4) to the Government.

- Distributor will pay RM2 (output tax of RM10 less input tax of RM8) to the Government.

At the end of the day, consumers are the ones who are paying for GST of RM10, and the Government, who eventually receives total GST of RM10.

Sources:

GST – Malaysia Goods and Services Tax in Year 2011

Goods and Services Tax in Malaysia

0 comments